Net operating margin formula

Operating Profit Margin formula. An equation for net income.

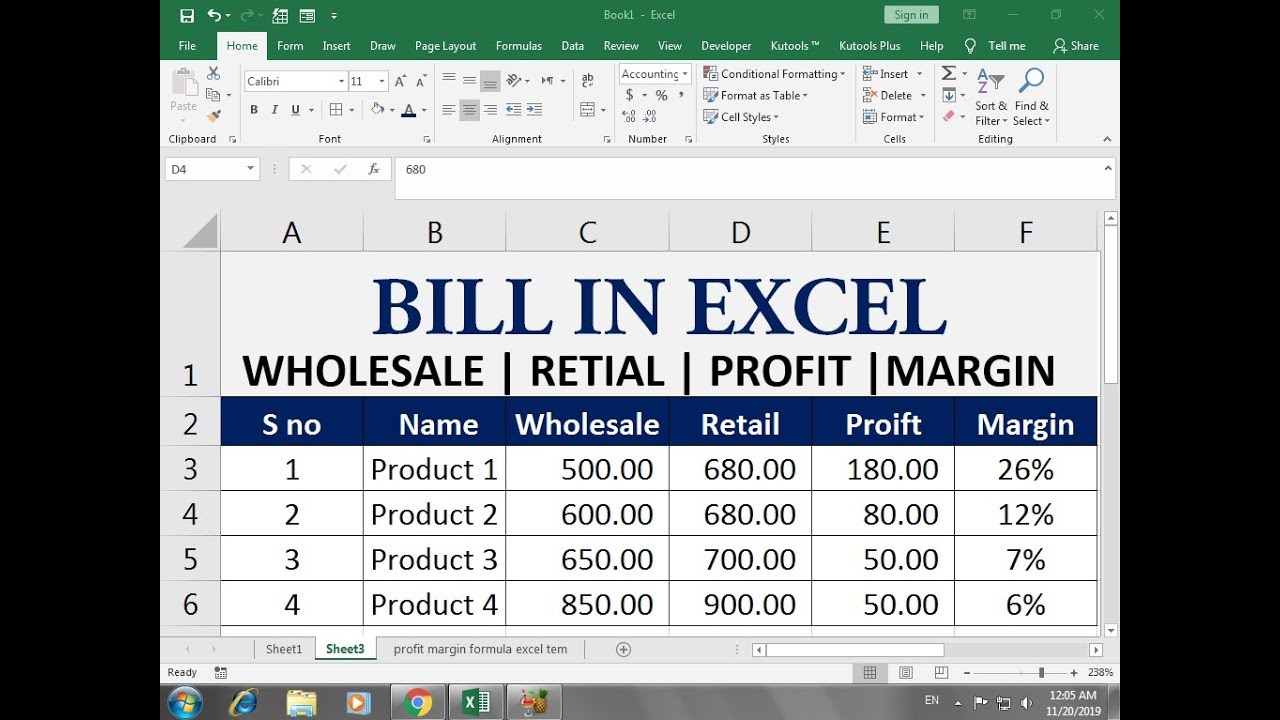

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

So if a company had an operating profit of 50 generated from 200 in revenue the operating margin would be.

. Let us understand the formula for Operating Profit. Gross Margin Net Sales Cost of Goods Sold Net Sales 100. The EBITDA margin is a specific measure of kind of profit margin While it is probably the most commonly used profit margin there are others such as gross profit margin operating margin and net profit margin.

This gross margin formula gives a percentage value. EBITDA Margin is the operating profitability ratio which is helpful to all stakeholders of the company to get a clear picture of operating profitability and its cash flow position and is calculated by dividing the earnings before interest taxes depreciation and amortization EBITDA of the company by its net revenue. Bond Equivalent Yield Formula.

Apples net profit margin for 2017 was 21. Net Operating Income 500000 350000 80000. A companys operating profit margin is operating profit as a percentage of revenue.

The company itself might have some investments and must be earning interest on those investments. Operating Profit is the net amount after operating expenses has been deducted from Gross Profit Revenue - Cost of Goods Sold Heres the formula. From this example we find that the net margin of Uno Company is 1225.

Operating Margin vs. The RNOA figure provides useful insights into a companys ability to generate profits from equity resources. Let us take the example of Apple Inc.

Unit contribution margin per unit denotes the profit potential of a product or activity from the. Using the formula of net margin we get Net Margin Formula Net Profit Net Sales 100. But to find out the net sales we need to deduct any sales return or sales discount from the gross sales.

Operating income is calculated using the formula given below. This figure is calculated by dividing net profit by revenue or turnover and it represents profitability as a percentage. Net margin is an important number to know about any company you plan to invest in.

Operating Margin Formula Calculator. Operating margin is a margin ratio used to measure a companys pricing strategy and operating efficiency. Net Operating Income 70000.

Net Operating Income Formula Example 2. The cost of goods sold is how much it costs your business to sell those goods. Gross margin formula.

Return on Net Operating Assets 130000 550000. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm. According to our formula Christies operating margin 36.

Understanding how Operating Profit is calculated is important in calculating the margin. Net profit margin is the ratio of net profits to revenues for a company or business segment. Net income can also be calculated by adding a companys operating income to non-operating income and then subtracting off taxes.

The formula for Operating Profit Margin is similar to other profitability ratios. Net Interest Margin Investment Income Interest Expenses Average Earning Assets. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

In that case we will be able to interpret whether the net margin of Uno Company is. To calculate the concept of net operating income in the case of a real-life company. Revenue growth and operating profit margin.

The net profit margin percentage is a related ratio. The gross margin formula is as follows. Gross profit margin and net profit margin are two profitability ratios used to assess a companys financial stability and overall profitability.

We start the income statement with the gross sales. Operating Margin Operating Income Net sales 100 70898 Mn 265595 Mn 100 2669. Operating Profit Net Sales Operating expenses.

Using the net margin formula we divide the 30000 net profit by the 100000 total revenue to obtain our net margin percentage. The total revenue is how much your business makes out of net sales. We take Operating profit in the numerator and Net sales in the denominator.

Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. Typically expressed as a percentage net profit margins show how much of each dollar collected by a. Operating margin is one of the popular measure used by the financial industry and it measures how much profit the firm or the company is making on a dollar of revenue or sales after accounting and paying for the variable costs of production like raw materials and wages but before.

Therefore DFG Ltd generated net operating income of 70000 during the year. Gross sales are the total revenue earned by the company. Suppose we compare this net margin with the net margin of companies under a similar industry.

Here is how Christie would calculate her operating margin. Gross margin Total revenue Cost of goods sold Total revenue x 100. Learn how they differ.

Net Interest Margin Formula Net Interest Margin Formula Net Interest Margin is a popular profitability ratio used by banks which helps them determine the success of firms in investing in comparison to the expenses on the same investments. Hence Return on Net Operating Assets 02363 or 2363. This means that 64 cents on every dollar of.

The gross the operating and the net profit margin are the three main margin analysis measures that are used to intricately analyze the income statement activities of a firm. Remember the operating expenses contain costs which the business has more control over. While operating margin considers only the cost of goods and operating expenses involved in production net profit margin also factors in the interest and taxes.

We can represent contribution margin in percentage as well. Return on Net Operating Assets NI Net Operating Assets. Calculation of the formula.

Net Margin Net margin also referred to as net profit margin is the third financial metric that can be used to measure business profitability. Both values can be obtained from the Income statement. As you can see Christies operating income is 360000 Net sales all operating expenses.

Operating Income Net Earnings Interest Expense Tax. Operating Income 100000 15000 20000. Finally the formula for gross margin can be derived by dividing the gross profit step 3 by the net sales step 1 and then multiply by 100 as shown below.

The second component in the above operating margin formula is net sales. And comparing a companys margin to its competitors can show you how well. The First step in calculating the net interest margin equation is to sum up the investment returns also known as interest income.

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

Operating Leverage A Cost Accounting Formula Cost Accounting Increase Revenue Business Risk

Gross Profit Accounting Play Accounting Medical School Stuff Accounting And Finance

Inventory Turnover Ratio Inventory Turnover Cost Of Goods Sold Financial Analysis

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Airbnb Rentals Rental Income Being A Landlord

How Balance Sheet Structure Content Reveal Financial Position Financial Financial Position Business Risk

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

Pin On Real Estate

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And T Contribution Margin Income Statement Cost Of Goods Sold

Net Income Formula Calculation And Example Net Income Accounting Education Accounting Principles

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Return On Assets Managed Roam Return On Assets Financial Management Asset

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Formula For Net Profit Margin In 2022 Net Profit Net Income Profit